Kelly Economic Report

May brings plenty of reasons to celebrate with loved ones thanks to many holidays – Cinco de Mayo, Mother’s Day, and Memorial Day. However, there seems to be less to celebrate in the world of finances. April was the worst month of the year so far for the stock markets, and inflation continues to remain higher than the Federal Reserve’s 2% target rate, making cuts to interest rates less likely to occur at all this year.

The Consumer Confidence Index, a key indicator of economic health, experienced a significant decline in April, dropping to 97 from 103.1 in March. This was well below economists’ expectations of 104 and marks the lowest point since mid-2022. The decline was driven by concerns over future business conditions, labor market conditions, and income expectations. Consumers’ worries about inflation, higher cost of living, and the possibility the Fed won’t cut rates before summer’s end were also factors. The upcoming presidential election and global conflicts are further dampening consumer confidence.

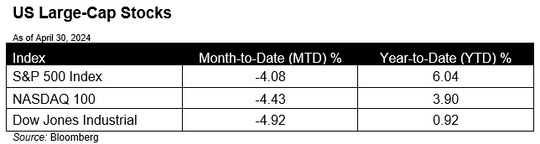

Stocks

Equities dropped in April, with all three major U.S. equity indices down by at least 4% for the month. Higher-than-expected inflation data coupled with lower-than-expected economic growth heightened investors’ concerns, and as such, the markets pulled back. Despite the pullback, earnings have been largely positive for U.S. equities. With just over half of S&P 500 companies reporting in, the current growth rate for earnings is 5.23%, and a similar sales growth at 4.29%. As the year continues, strong economic growth may delay the Fed from cutting interest rates but enable companies to post strong top and bottom-line figures.

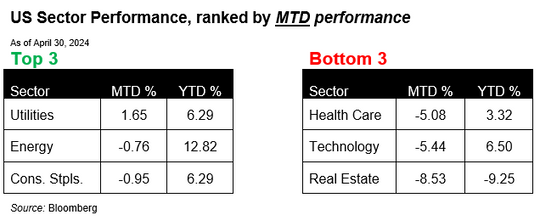

Sector Performance

In a staunch reversal from March, only one sector, the defense-oriented Utilities sector, ended the month positive. Utilities have been performing well in recent months, with several companies announcing they’re raising dividends and focusing on reducing debt. The weakest sector in April was Real Estate, which continues to be impacted by high mortgage rates, making homeownership unaffordable for many looking for new homes. Technology, one of the top performers in 2023, continues to rank toward the bottom, falling over 5% for the month as the gap in market sector performance widens.

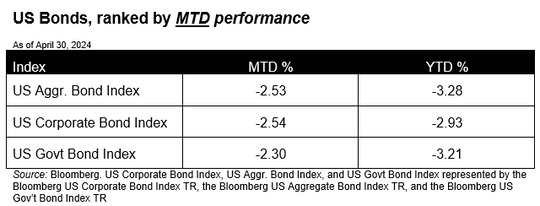

Bonds

Fixed income had its worst month of the year as rates climbed to highs not seen since last November. Each fixed-income index finished the month down over 2%, with longer-duration assets declining the most. Interest rates on both the 2-year and 10-year Treasury continued to climb, with the yield on the 2-year crossing 5% on multiple occasions. Rates rose 42 bps and 48 bps for the 2-year and 10-year, respectively. The bond market continues to be impacted due to inflation rates remaining stickier than experts anticipated and the Fed’s decision to delay rate cuts.

Economic Update

The Consumer Price Index (CPI) accelerated for the second month and posted the fastest year-over-year growth rate since last September. Core prices (excluding food and energy) continued to climb, with rising energy prices driving the increase. The first quarter reading of Gross Domestic Product (GDP) came in weaker than expected at an annualized rate of 1.6%, indicating a potential softening in the economy. On a more positive note, the GDP report showed consumer spending remained strong, increasing 2.5% despite consumer sentiment falling in the most recent edition of the University of Michigan Consumer Sentiment Report.

The information was provided to DLI by:

Kelly Financial Advisors, LLC

410-349-3806

810 East College Parkway

Annapolis, MD 21409